Did you know that it’s estimated a staggering 75% of businesses fail to sell?

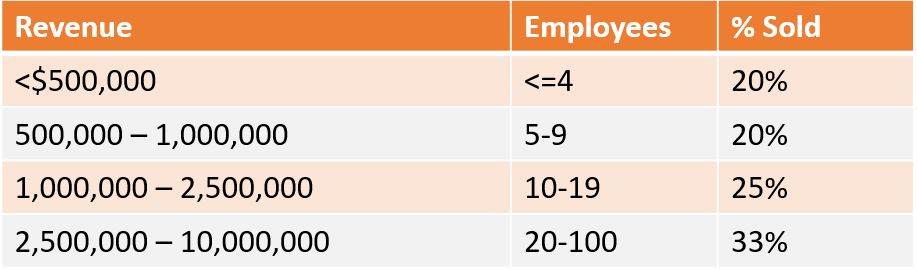

In the 15th edition of The Business Review Guide, Tom West attempted to answer the question of how many businesses are actually sold, and while it’s hard to get accurate data on private transactions, the data he collected provided an educated guess:

Those numbers are shocking! (Researched published by other companies paints an even bleaker picture).

And the number one reason for this unfortunate outcome is that most business owners simply don’t realize the importance of preparing their business for sale, and how much it can cost them in lost value when they sell their business – if they can ever sell at all!

Planning for the sale of your business is a critical step that many business owners often overlook.

However, starting this process early can significantly impact the valuation of your business and ultimately, the success of your exit strategy. Here’s why:

Time is of the Essence

The process of preparing your business for sale is not an overnight task. It requires careful planning and execution, which can take anywhere from two to three years. This time allows you to make strategic decisions that can enhance the value of your business and make it more attractive to potential buyers.

Maximizing Business Value

Early planning allows you to focus on increasing the value of your business. This could involve improving profitability, streamlining operations, or investing in growth opportunities. By doing so, you can ensure that you’re not just ready to sell, but also that you’re able to get the maximum value out of your business.

Tax and Asset Protection

Early exit planning also allows for better tax and asset protection outcomes. By thinking about your exit strategy years in advance, you can implement a well-thought-out tax plan that is updated and implemented annually. This can help you to minimize your tax liability and protect your assets.

Reducing Risk for the Next Owner

A well-prepared business reduces the risk for the next owner. This not only makes your business more attractive to potential buyers, but it also increases the likelihood of receiving a higher price for your business.

Profitability and Valuation

In the two to three years prior to your exit, it’s crucial to focus on investments that will increase profits. This is because your profit or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) will impact your valuation. Avoid spending money on things that won’t directly affect your profitability, even if they seem like good long-term investments.

Conclusion

In conclusion, early planning for your business sale is not just a good idea, it’s a necessity. It allows you to maximize your business value, protect your assets, reduce risk for the next owner, and ultimately, achieve a higher valuation for your business.

So, start thinking about your exit strategy today – your future self will thank you.