The industry in which a business operates can play a crucial role in determining the valuation of the business, including the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiple used. How and why?

In this article, we will explore how the industry can impact the EBITDA multiple and why it is essential for business owners to understand these differences.

Industry-Specific EBITDA Multiples

Different industries have different EBITDA multiples due to various factors such as growth potential, risk, and market dynamics.

For instance, technology companies may have higher multiples due to their rapid growth potential, while manufacturing businesses might have lower multiples due to their capital-intensive nature and slower growth rates.

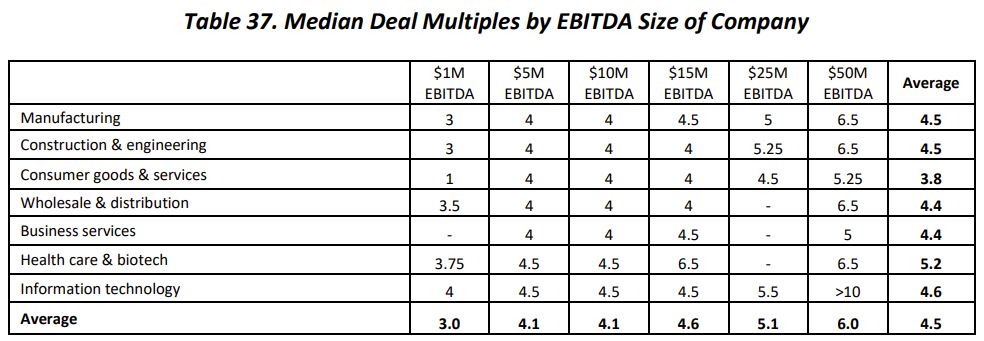

The 2023 Pepperdine Private Capital Markets Report shows Median Deal Multiples by business size and industry:

Understanding Industry Risk and Growth Potential

The risk associated with a particular industry is a significant factor in determining EBITDA multiples.

Industries with higher risk profiles tend to have lower multiples, as investors require a higher return on investment to compensate for the increased risk.

On the other hand, industries with strong growth potential and lower risk profiles often command higher EBITDA multiples.

Supply and Demand Factors

Market dynamics, such as supply and demand, also play a role in determining industry-specific EBITDA multiples.

Industries with high demand and limited supply of companies may experience higher multiples, while industries with an oversupply of businesses or lower demand may see lower multiples.

Repositioning a Business for Higher EBITDA Multiples

One way to increase a company’s EBITDA multiple is by repositioning the business into a higher multiple industry.

This can involve pivoting the company’s focus, adding new business units, or divesting underperforming units that may be dragging down the overall valuation.

By strategically repositioning the business, entrepreneurs can create more value without necessarily changing much about their core operations.

Conclusion

In conclusion, the industry in which a business operates has a significant impact on the EBITDA multiple used when valuing the company.

Business owners should be aware of the differences in multiples across industries and consider strategies to increase their company’s value, such as repositioning their business into a higher multiple industry or focusing on growth opportunities within their current industry.

By understanding these factors, entrepreneurs can work towards maximizing their company’s worth and potential exit value.